As you are preparing to go to college, you and your parents have done all the research for the best college, purchased all the items for your dorm and considered the best options to pay for college. Some people say learning from one’s mistakes is part of life; however, it can be costly in the long run. We recommend that you take some time researching about borrowing for college before taking any loan.

You have the power of knowledge in your fingertips with technology and the internet. We hope to provide you with a few tips on how to avoid some mistakes during your educational career when it comes to borrowing.

FAFSA, FAFSA…fill out the FAFSA

The Free Application for Federal Student Aid (FAFSA) is mandatory for financial aid office to award any type of financial aid. The types of financial include grants (federal, state and institutional) and federal student loans. You will need to complete this application process every year for the financial aid office to award aid. If you do not submit the FAFSA to the school every year, then you will not receive a dime in financial aid. Place a recurring reminder on your calendar so you remember to complete the FAFSA. The FAFSA is available each October 1st for the next academic year.

Some types of financial aid are available on a first-come first-served basis, so it is crucial that you submit the FAFSA as early as possible. Another mistake to avoid is to not submit any inaccurate information as it can impact the amount of financial aid that is awarded. Proof and double check your entries on the form to save time!

Free Money Options

Federal and private student loans may be a must to obtain a higher education, but you should understand that you will need repay loans with interest. Scholarships and grants are free money. You probably applied for scholarships during high school, but it does not end there. During your years in college, search and apply for Wentworth Endowment Scholarships as well as for national and local scholarships. Free money means less money in loans you need to borrow!

Understanding Private Student Loans

Many of you will need to take out a private loan to cover the difference of your costs and financial aid. You need to do your research on the lenders who offer private educational student loans. These loans may have higher interest rates and less flexible terms than your federal student loans. These loans do not offer forgiveness options. Think of these loans as your last resort.

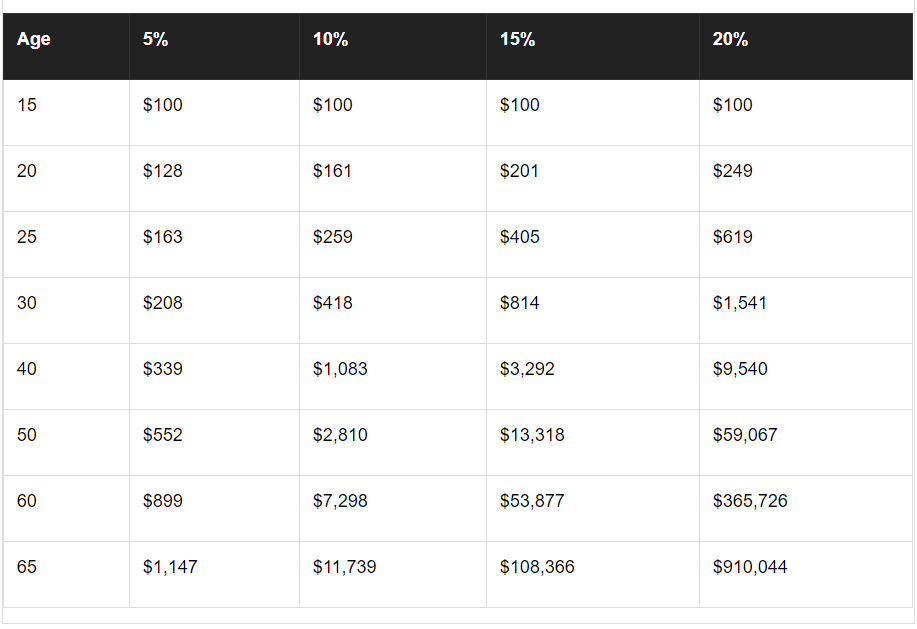

When applying for the loans, you do not have apply or request the maximum amount allowed. You will need to pay interest on all the money you borrow. More importantly, interest will continue to accrue throughout the 4 years that you are enrolled in college and will continue throughout the repayment period. The interest can add up considerably for the lifetime of the loan.

Research the options that best fit you and your needs. Do the work at the beginning of the loan process by comparing lenders and rates. Read the terms and conditions of the loan carefully. Wentworth has a historical list of lenders, but you can use a lender that is not on this list. Research some of your options at elmselect.com.

Tips:

- We recommend you start the application process early on as you may need to find a co-signer. The process may involve a few steps and days to be approved.

- Be sure to read the eligibility requirements of the lenders as some of them require at least half-time status or you must be meeting SAP (Satisfactory Academic Process).

- Communicate with your Billing Counselor if you have questions about the amount to request on the application, and the refund process and timelines.

- Ask your lender if you have questions about the terms of the loan.

- Discuss your options with your Financial Aid Counselor. Ask questions if you are unsure of what dates to use on your loan application as the Financial Aid Office certifies the funds to be sent the school based on the dates you indicated on the application.

- If you elect to use different lenders throughout your educational career at Wentworth, keep in mind you will have multiple monthly payments after graduation.