Now you may have heard those three magic words in recent times and filed them away in some portion of your brain to access later. Well, shockingly enough, it is now time to access those files and prepare yourself for the 2017/2018 FAFSA. Yes, you read that right.

About a year ago, President Obama made some small (aka large) changes to the FAFSA in terms of timeline and availability. Instead of the January 1st launch day for FAFSA, the FAFSA will now be available October 1st. Yes. October. 1st. Instead of using prior year income (meaning for 2016 FAFSA you used 2015 income data) the FAFSA will now utilize income information from two years prior.

Now you see how we got the name Prior-Prior Year.

You may be wondering what the benefits are to using income information from two years prior, rather than one year. Well the top benefit (in our opinion) is that your taxes will already be filed when you go to do the FAFSA. You will no longer have to estimate your income information and then go back into the FAFSA after you’ve filed to update your information. Even better, is that for most people they should be able to use data retrieval and directly import their data into the FAFSA.

For the upcoming FAFSA year, there will be a bit of a unique situation where the same tax info is used for two years. This makes it even more important to update your FAFSA with the correct figures so you don’t run into any issues in October!!

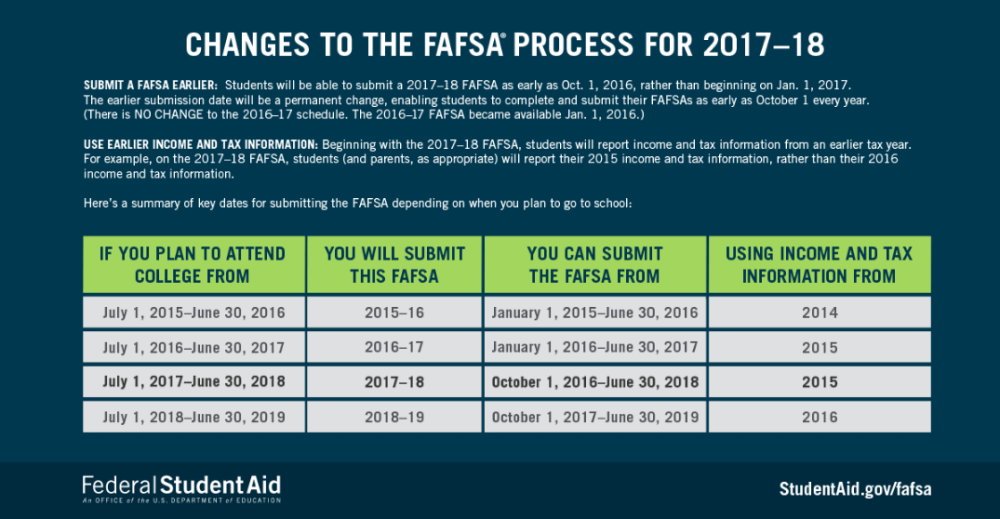

Federal Student Aid made a handy little chart which will help you visualize what FAFSA you need to submit depending on when you plan on enrolling

It is important to note that here at Wentworth our timelines aren’t really going to be changing. We still have to wait on other information from the Department of Education before we are able to put awards available so even though FAFSA will be out in October students can still expect to receive their award info between March- June depending on if you are a new or returning student.

Want more info? We have a plethora of helpful resources provided below!

https://studentaid.ed.gov/sa/about/announcements/fafsa-changes

https://community.saltmoney.org/community/paying-for-college/blog/2016/8/22

http://wit.financialaidtv.com/#playlist-13876:video-0

Until next time!

Mady